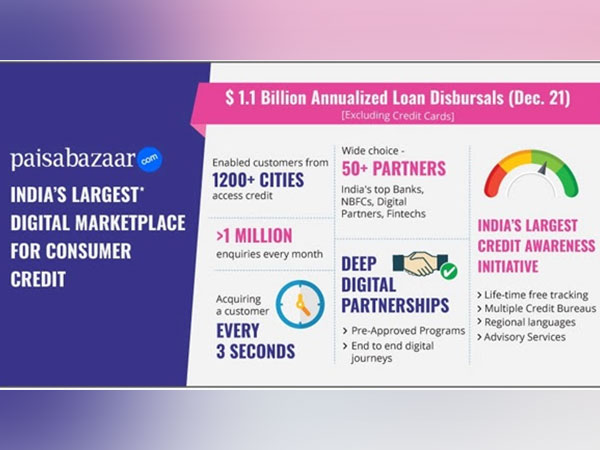

Paisabazaar.com reaches USD 1.1 billion annualized loan disbursal rate, provides access to credit across 668 cities

Jan 13, 2022

Gurugram (Haryana) [India], January 13 (ANI/NewsVoir): Paisabazaar.com, India's largest* digital marketplace for consumer credit, announced today that it has reached an annualised loan disbursal rate of $ 1.1 billion (excluding credit card issuance).

In December 2021, the fintech disbursed ~Rs. 695 crore of loans, which included unsecured loans like personal and business loans and secured loans like Home Loans and Loan Against Property.

Since March 2020, the pandemic had deeply impacted the lending industry, and Paisabazaar says along with external factors like the lockdown, moratorium and overall economic disruptions, the lack of digital infrastructure within the lending industry and over-reliance on physical processes led to plummeting of supply of new credit.

However, with gradual and steady resumption of economic activities and shift towards digital-led lending processes within the industry, lending volumes have steadily increased in the last 12-15 months, albeit a brief lean period caused by the second covid wave in April-May 2021.

"As challenging as it was, the pandemic has proved to be an inflection point for the lending industry, where we now have more digital-focussed processes, robust underwriting models and sustainable systems. As the country's leading marketplace platform, we have strongly focussed on deepening partnerships and building digital infrastructure in the last 18 months, to serve the credit needs of our diverse consumer segments seamlessly," said Naveen Kukreja, CEO & Co-founder, Paisabazaar.com.

Helping Consumers from over 650 cities access Credit every month

According to Paisabazaar, as the lockdown restrictions were eased and economic activities resumed, it has been able to serve the credit needs of customers from a larger number of geographies. It currently receives over 1 million enquiries for credit on its platform, and till date has served the needs of customers from over 1200 cities and towns.

In December alone, customers from 668 cities and towns accessed credit through the Paisabazaar platform.

"At a time when physical interactions were a challenge, we were able to digitize the lending process end to end, to enable customers from across the country to avail credit seamlessly from our platform. The increased focus of our partner Banks and NBFCs to build completely digital journeys with us was a big enabler, resulting in enhanced customer convenience through paperless and presence-less processes along with quicker decisioning and disbursals," said Gaurav Aggarwal, Senior Director & Head of Product & Analytics, Paisabazaar.com.

Digital processes on Paisabazaar include innovations like Digital KYC through c-KYC integration and Offline XML-based Aadhar KYC, Video-KYC, Liveliness checks through video, Digital documents upload/validation, e-Mandates, Optical Character Recognition ( OCR), e-Sign etc. to digitize all legs of the lending process.

More than half of Loan disbursals are to customers from outside top 5 metros

With increased digitization and rising demand for credit throughout the country, Paisabazaar.com today disburses a higher share of loans to geographies, outside the Top 5 metros of Delhi NCR, Mumbai, Chennai, Bengaluru and Kolkata. On an average, ~55% of total value of loans in a month are disbursed to Paisabazaar customers from outside the top 5 cities.

Also, the platform is witnessing higher number of loans being disbursed to younger consumer segments. Over 50% of the number of loans that are disbursed through Paisabazaar in a month are taken by customers less than 35 years of age, 26% by customers less than 30.

"Increase in the supply of credit to varied segments and geographies despite Covid still lurking around us is a testament to the fact that the lending industry is now more resilient and robust. At Paisabazaar, our focus remains on strengthening our business fundamentals and easing access to credit for varied consumer segments visiting our platform, through product and process innovations, using analytics, technology and partnerships, to add value to both our consumers and the overall lending ecosystem," added Naveen Kukreja.

*As per market share, according to a Frost & Sullivan Study

Paisabazaar was India's largest consumer credit marketplace with a 51.4% market share, based on disbursals in Fiscal 2020, as per Frost & Sullivan.

Paisabazaar has 50+ partnerships with large banks, large NBFCs and fintech lenders to offer a wide choice of lending products for consumers on its platform. These strong partnerships, built through technology and data integration with Lending Partners to provide real-time data flow and status updates, allows the Paisabazaar platform to offer quick decision making, ease of processes and faster disbursals.

From application to disbursal, Paisabazaar accompanies the Consumer at each step, providing last-mile assistance such as document collection and assistance until disbursal and advice.

Paisabazaar, since 2016-17, has also been providing consumers access to credit reports from credit bureaus, offering Consumers lifetime checking and tracking of their credit scores for free.

Paisabazaar has been recognized at several industry platforms with awards like 'Most Innovative Lending Startup' & 'Best Fintech Consumer Lender' by India Fintech Forum and Economic Times' 'Most Promising Brand', 'Digital Lending Award' at the Fintech India Innovation Awards, 'Excellence in Consumer Lending' at IAMAI's India Digital Awards, 'Outstanding Crisis Finance Innovation 2021 (Asia Pacific) Award' by Global Finance Magazine

For further information on Paisabazaar, please refer to the website: www.paisabazaar.com.

This story is provided by NewsVoir. ANI will not be responsible in any way for the content of this article. (ANI/NewsVoir)